This is my personal review of using InvestEngine for my business and investing in index funds passively. I'm not a financial expert by any means so make sure you're sensible and do your own research before making any risky decisions when it comes to investing. I also don't have tonnes of risk and compliance teams behind me so I also can't guarantee everything is fully accurate on this post.

InvestEngine ISAs - Low Cost Investing

In the world of fintech, InvestEngine has been making notable waves with their innovative investment services. Offering a unique blend of robo-advisor technology and bespoke services, InvestEngine has carved a unique niche for individual and business investors alike.

This blog post will concentrate on two of InvestEngine’s standout offerings – the Individual Savings Account (ISA) and Business Investment Accounts. These services highlight InvestEngine’s commitment to provide robust, flexible, and user-friendly investment platforms for various investor types.

InvestEngine

Start your Stocks & Shares ISA or business investment account with InvestEngine to invest in popular funds across well known providers like Vanguard, Fidelity and more.

Pros

- Low Fees

- FCA Regulated

- FSCS Protected

- Stocks & Shares ISA

InvestEngine’s Individual Savings Account (ISA)

An Individual Savings Account (ISA) is a class of retail investment arrangements available to residents in the United Kingdom. It offers favorable tax status with regards to income, capital gains, and inheritance.

InvestEngine’s ISA takes this concept a step further, integrating a powerful, automated investment management system. By using InvestEngine’s ISA, investors can take advantage of tax-free investing up to the annual ISA limit.

What differentiates InvestEngine’s ISA from traditional ones are its powerful features:

Automated Investment Management: Once you’ve set your risk level and investment goal, InvestEngine’s automated system takes over, consistently managing your portfolio to align with your objectives.

Diversified Portfolios: InvestEngine creates a diversified portfolio using Exchange-Traded Funds (ETFs) spanning various asset classes and regions, reducing risk and enhancing potential returns.

Low Costs: InvestEngine prides itself on its low management fees, making investing more accessible. Moreover, ETFs typically carry lower costs than traditional mutual funds, further saving on investment expenses.

Flexibility: InvestEngine’s ISA offers the option of a fully managed portfolio or a DIY approach, providing flexibility to suit different investment styles.

InvestEngine's Business Investment Accounts

Recognizing that businesses also have investment needs, InvestEngine offers specialized Business Investment Accounts. These accounts are aimed at businesses, trusts, and charities looking to put their surplus cash to work in the market.

InvestEngine’s Business Investment Account boasts several distinct features:

Bespoke Portfolios: InvestEngine creates custom portfolios based on the business’s risk tolerance and investment horizon, ensuring the investments align with the business’s financial goals.

Professional Management: The portfolios are professionally managed, relieving businesses of the daily stresses of investment management.

Transparent Pricing: InvestEngine operates on a low-cost model, ensuring businesses keep a larger portion of their returns.

Online Dashboard: Businesses have 24/7 access to their investments via an easy-to-use online dashboard, ensuring they’re always up-to-date with their investment status.

InvestEngine

Start your Stocks & Shares ISA or business investment account with InvestEngine to invest in popular funds across well known providers like Vanguard, Fidelity and more.

Pros

- Low Fees

- FCA Regulated

- FSCS Protected

- Stocks & Shares ISA

InvestEngine VS Vanguard

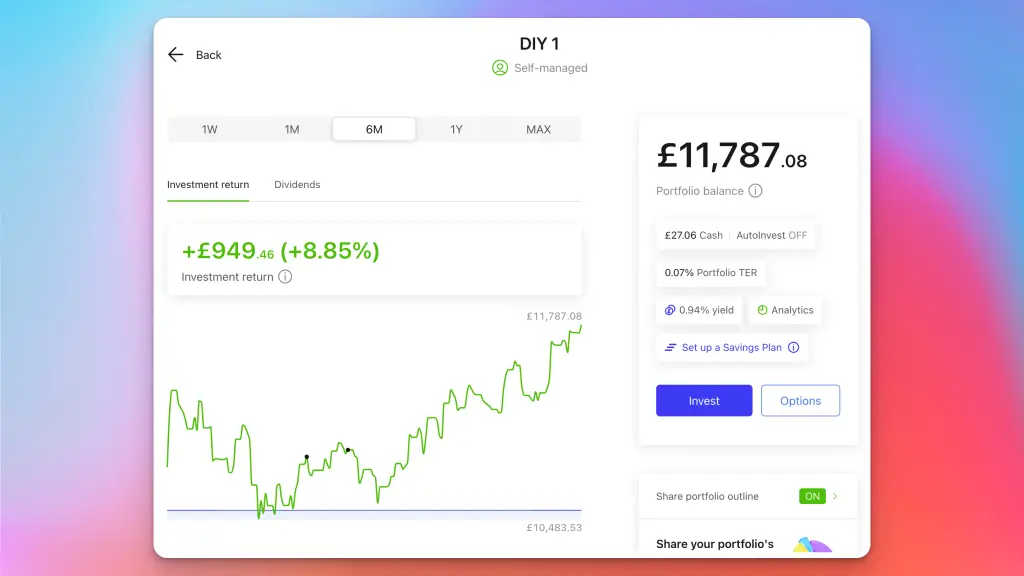

About 6 months ago, I needed to find a bank account to invest my company profits into. Traditionally it’s been very hard to open a business investment account, usually with large outdated platforms with incredibly manual paper based processes.

Naturally, I was keen to explore investengine due to it’s slick fintech approach, easy onboarding experience and low platform fees at the time of writing and I’ve been pleasantly surprised so far.

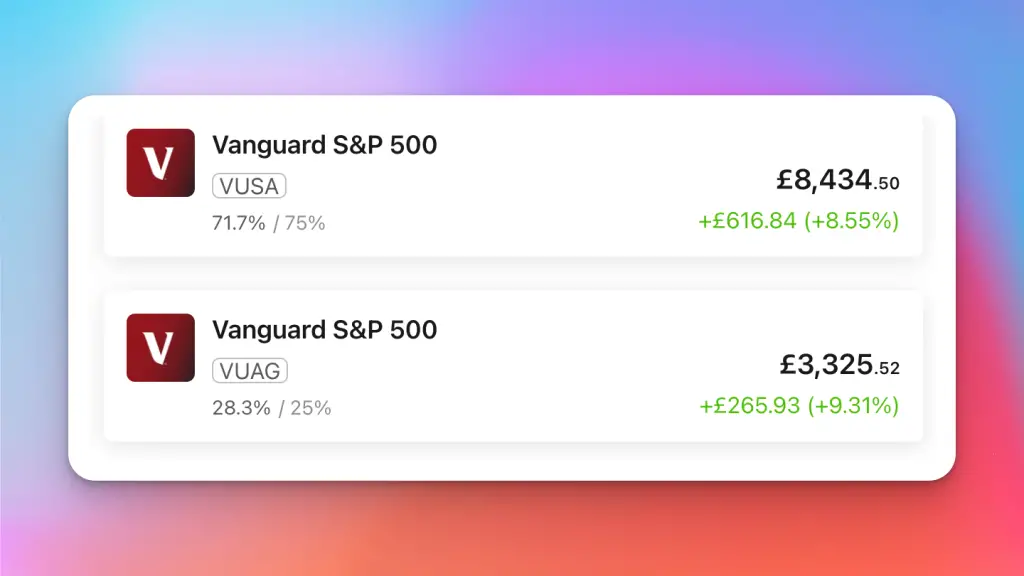

I’m also a big fan of the Vanguard investing platform, I have a personal investment account on there so being able to combine the low fees of the InvestEngine platform and fund availability of Vanguard, it meant I could invest in my favourite funds like VUSA and VUAG which primarily focus on the S&P500 – the top 500 companies in the US which historically has averaged 7% gains a year since it’s inception.

I can also check out my whole portfolio to look at the number of companies that I’ve invested in and all of the individual companies as well as my exposure to each of them. It’s super handy to know where my money is actually invested. With most of it being in the S&P500 it’s no surprise that you’ll see a lot of companies like Meta, Apple, Berkshire Hathaway, Amazon and more.

Is InvestEngine Safe?

I always make sure, wherever my money is invested that the firm is regulated by the FCA. Thankfully, InvestEngine have all the right UK regulation in place.

All regulated companies in the UK must show this caveat at the bottom of the web page as well as their FCA Registration Number:

InvestEngine® is the trading name of InvestEngine Limited. InvestEngine (UK) Limited is Authorised and Regulated by the Financial Conduct Authority, [FRN 801128]. InvestEngine is incorporated in the UK with company number 10438231 and is registered at Lawford House, Albert Place, London, United Kingdom, N3 1QA

They are also part of the FSCS (Financial Services Compensation Scheme) up to £85,000 which means if they went busy, then Investments up to £85,000 may be eligible for claims so that you get your money back, this is pretty standard in the UK and I personally wouldn’t invest somewhere that wasn’t FSCS protected and of course FCA regulated.

InvestEngine

Start your Stocks & Shares ISA or business investment account with InvestEngine to invest in popular funds across well known providers like Vanguard, Fidelity and more.

Pros

- Low Fees

- FCA Regulated

- FSCS Protected

- Stocks & Shares ISA

Investengine ETF List

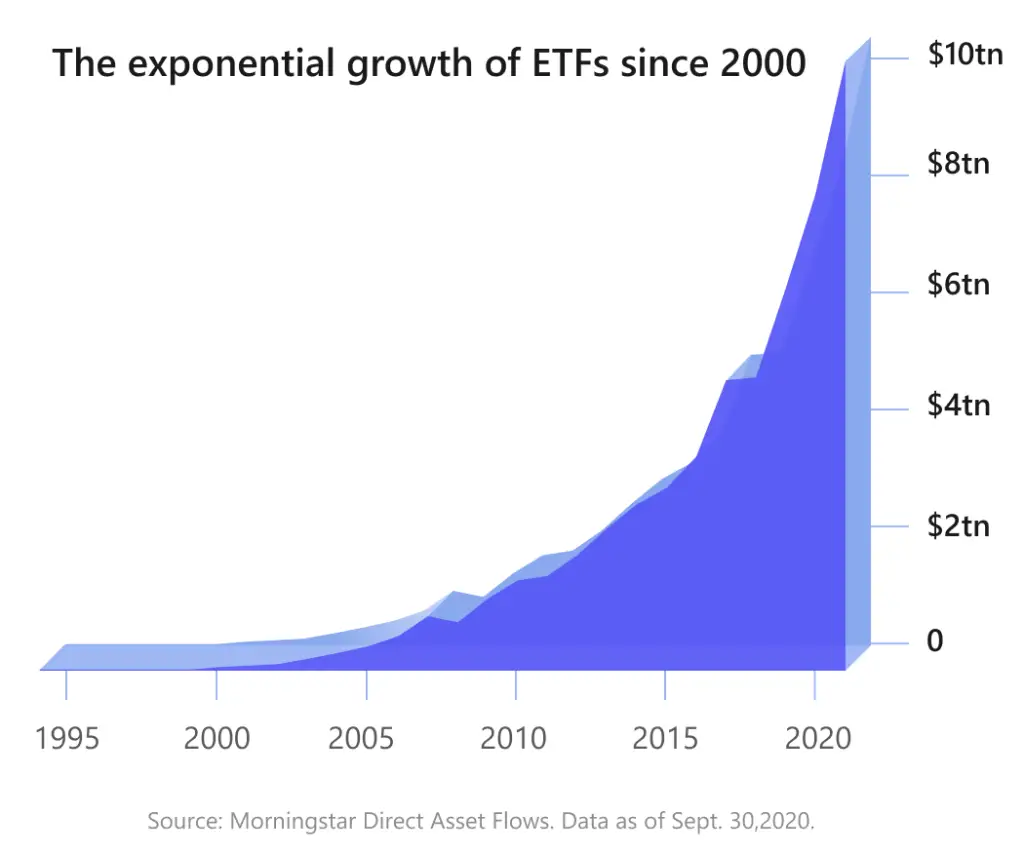

An Exchange-Traded Fund, or ETF, is a specific kind of investment fund constructed to mimic the activity of a financial index or stock market. Take the iShares S&P 500 ETF as an example, which mirrors the performance of 500 of the most significant American businesses such as Apple, Amazon, and Tesla – collectively referred to as the S&P 500 Index. ETFs operate like regular shares on the stock exchange, hence the name ‘exchange-traded funds’.

There are many popular funds from well known providers like Vanguard on the InvestEngine platform.

Top InvestEngine ETF Funds

| ETF Name | Ticker |

|---|---|

| iShares Physical Gold | SGLN |

| iShares S&P 500 | IUSA |

| Vanguard S&P 500 | VUSA |

| Vanguard FTSE All-World High Dividend Yield | VHYL |

| Vanguard S&P 500 | VUAG |

| Vanguard FTSE Developed World | VHVG |

| iShares MSCI Emerging Markets IMI | EMIM |

| Invesco S&P 500 | SPXP |

| iShares FTSE 100 | CUKX |

| iShares MSCI World Small Cap | WLDS |

Can You Use Fractional Investing on InvestEngine?

Fractional investing is a method that enables investors to start investing with as little as £1 in any ETF available on our platform, regardless of the ETF’s actual share price. This investment technique effectively democratizes access to high-valued ETFs that may have been otherwise prohibitive due to their substantial share price. Fractional investing, therefore, facilitates immediate diversification of your portfolio by allowing you to acquire a piece of even the priciest ETFs, ultimately creating an inclusive investment landscape.

Introducing the concept of Smart Portfolio Top-ups, InvestEngine simplifies the process of buying and selling as per your comprehensive investment strategy. With just a few clicks, you can invest following your selected portfolio weights, leveraging our innovative smart order technology.

But how does it work? Imagine this as your personal investment assistant that crunches the numbers, strategizes and executes the trades, effectively taking the complexities of managing a diverse portfolio off your shoulders. This means that when you decide to add funds to your portfolio or rebalance your investments, our smart order technology calculates and conducts individual trades on your behalf.

It’s not just about convenience; it’s also about optimizing your portfolio performance. The technology assesses market conditions, the current state of your portfolio, and your predefined investment strategy. It then performs a series of smart trades to ensure that your investments align with your chosen portfolio weights. In short, InvestEngine’s smart portfolio top-ups provide a more efficient and strategic method of managing your investments, making portfolio optimization more accessible and less daunting.

InvestEngine

Start your Stocks & Shares ISA or business investment account with InvestEngine to invest in popular funds across well known providers like Vanguard, Fidelity and more.

Pros

- Low Fees

- FCA Regulated

- FSCS Protected

- Stocks & Shares ISA

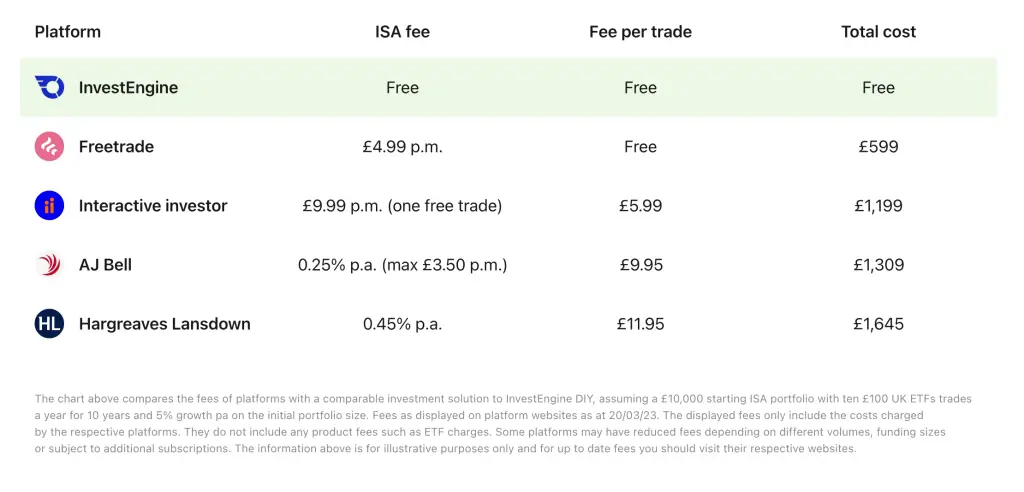

How Much Does InvestEngine Cost? (Fees)

Affordable Investing with InvestEngine

Investing has been an indispensable method to grow wealth for centuries. However, the prohibitive costs associated with traditional investment firms often deter individual investors. This is where InvestEngine, an innovative investment platform, steps in to revolutionize the industry.

InvestEngine distinguishes itself from the crowd by offering unparalleled value through commission-free DIY (Do-It-Yourself) investing and low-cost Managed Portfolios. Their focus is on removing the barriers to investment by eliminating common fees that can eat into an investor’s returns.

Zero Trading and Inactivity Fees

One of the most enticing aspects of InvestEngine’s model is their commitment to zero trading fees. Unlike many platforms, which charge a fee for each transaction, InvestEngine allows investors to trade without this financial burden. Furthermore, they also eliminate inactivity fees – a charge that some investment platforms impose if an investor’s account is not frequently used. This approach is particularly beneficial for investors with a long-term perspective who do not frequently buy and sell assets.

Low-Cost Managed and DIY Portfolios

InvestEngine offers a variety of services to cater to every type of investor. For those who prefer professional assistance with their investments, InvestEngine’s Managed Portfolios provide an excellent solution. These portfolios carry a minuscule annual fee of 0.25%. Even better, this fee drops to 0.20% for portfolios exceeding £100,000. This is significantly lower than the industry average, enabling investors to keep a larger portion of their returns.

For the hands-on investor, InvestEngine provides DIY Portfolios. These portfolios are entirely commission-free, allowing investors to take control of their investments without the worry of transaction costs. This feature caters to the active investor who enjoys making frequent trades to optimize their portfolio.

The Role of ETFs

InvestEngine primarily uses Exchange Traded Funds (ETFs) in its portfolios. ETFs are known for their low costs and broad diversification. The ETFs utilized by InvestEngine typically have charges ranging from 0.07% to 0.30% per annum. However, they caution that certain ETFs might incur charges from the London Stock Exchange’s Stamp Duty or Stamp Duty Reserve Tax.

Independent Advice

While InvestEngine provides a range of services and features to assist with investing, they emphasize that they do not provide advice. They recommend investors to seek independent financial advice. This highlights their commitment to transparency and ensuring that their clients make informed decisions.

InvestEngine’s commitment to low-cost, accessible investing makes it a noteworthy option for both new and experienced investors. Whether you’re a DIY investor or prefer a managed portfolio, InvestEngine has solutions designed to maximize your investment potential while keeping costs to a minimum.

InvestEngine

Start your Stocks & Shares ISA or business investment account with InvestEngine to invest in popular funds across well known providers like Vanguard, Fidelity and more.

Pros

- Low Fees

- FCA Regulated

- FSCS Protected

- Stocks & Shares ISA

10 Minute Read

10 Minute Read