Is Buy to Let Worth it?

This year, more than ever, more property investors and landlords are getting into the property market looking for a way to diversify their assets.

In the UK for those who have spare money and looking to invest it somewhere, that isn’t just in the stock markets are looking forward Buy to Let. Is Buy to Let worth it?

Let’s explore some key factors to help people like you get started in Buy to Let property.

How Much Can You Make from Buy to Let?

This really comes down to one major factor, how much do you have to invest in property and ultimately this will determine how much rental income you can get for a property.

Typically, you can make anywhere from £250 to £2000 profit per property, per month.

For example, if you’re renting out a property in London, you can probably get a good amount of rent for a flat in one of the central zones and there’s a lot of competition. This might mean that you make £2000 a month for a 2 bedroom flat which is quite typical.

On the other hand, your mortgage might mean on a £500,000 flat in London you’re paying about £1500 a month on your mortgage and your profit is then only about £500 a month after your costs.

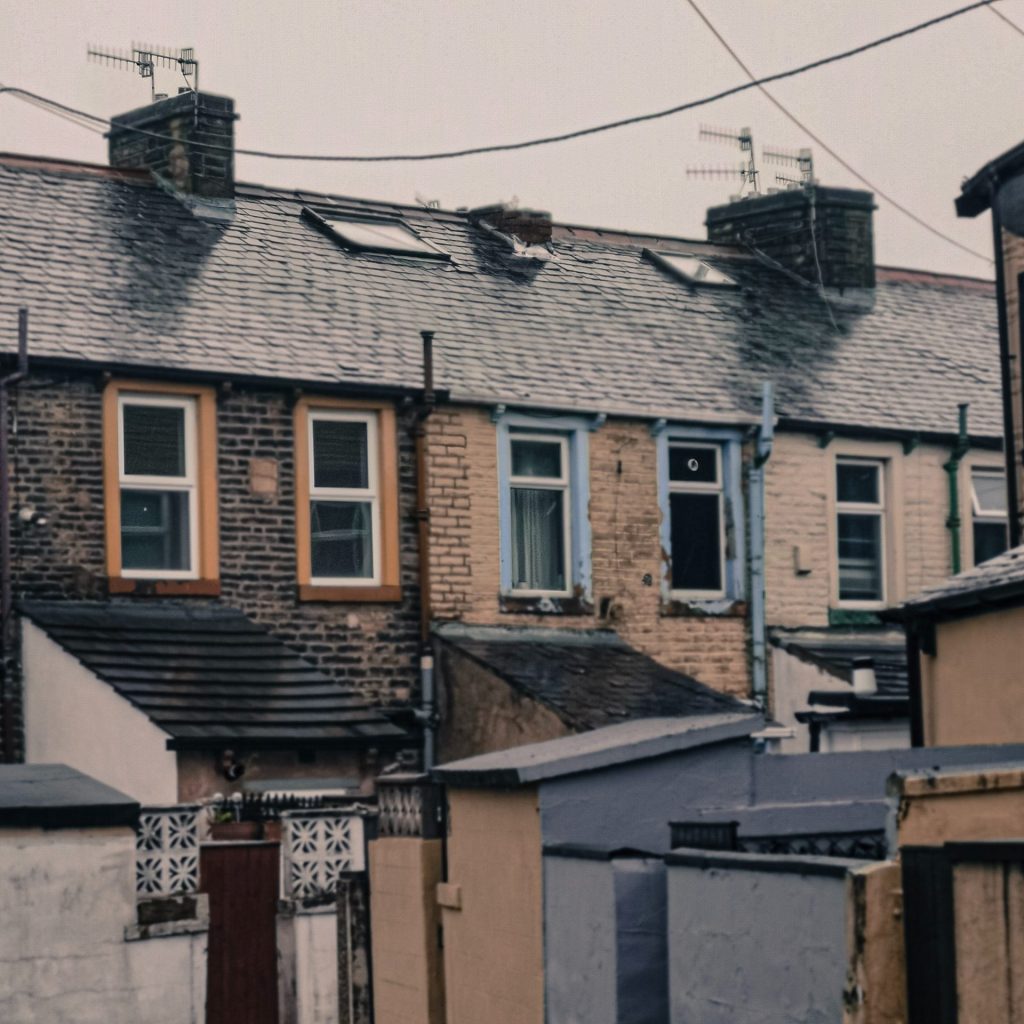

Typically, buying in the north where properties are cheaper can bring a higher yield. This is the income of the property (Gross or Net) divided by the value of the property. Up north you might be able to get about 8 – 10% yield, where as down in London and the south you’ll be looking at about 2 – 3 % yield.

My first buy to let property was bought in the north for £106,000 and I rent the property out for £780 a month, the mortgage is £200 a month on an interest only buy to let mortgage. This leaves me about £6000 a year profit from one property. Here’s the figures:

Example

Annual Gross Rental Income: £9360 per year (£780 per month)

Annual Mortgage Payments: £2400 (£200 per month)

10% Maintenance: £936 (£78 per month)

Net Rental Profit: £6024 Profit per Year

Not bad from a single property, of course this is before any taxes and company expenses so factor this in mind.

Ideally you want to be aiming for around a 20 – 30% return on investment per year. This means that you take your profit, divided by the money you’ve invested in.

On this particular property, I initially invested about £50,000 into it, this includes:

Deposit: £26,000

Stamp Duty: £3500

Legals: £1500

Other Fees: £2000

Refurbishment: £17,000

Total Cash In: £50,000

This means that my ROI (Return on Investment is £6024 divided by £50,000 which is a 12% ROI. Sounds quite low?

That’s because I created capital appreciation and uplift on the property during the refurbishment which created equity which I haven’t yet taken out.

The property these days is worth about £170,000 based on sold comparables in the area.

This means when I refinance the property in a year and put it onto a new fixed term, the bank will pay be 75% towards the new market value.

If you add up all my costs plus the mortgage, this is an £81,000 mortgage and a £50,000 cash investment that I put into it which totals £131,000 to acquire the property and from that, it’s worth £170,000 because of the refurbishment, creating £39,000 of equity.

75% of £170,000 on the new mortgage is £127,500 – this is how much the bank will give me towards a new mortgage based on the updated value of the property.

That £127,500 is used to pay off the following costs:

The Old Mortgage: £81,000

My Costs £50,000

This leaves £3500 of my money in the property, the remainder that is used for the new 25% deposit (£42,500 25% deposit required) is the equity generated (The £39,000 mentioned before) plus the £3500 I leave in the property.

With the original lender repaid, and the 25% deposit funded through the equity and £3500 of my cash. That means that I take out the remaining £46,5000 of my original money and I can recycle it to go again on the next property.

This massively impacts Return on Investment (ROI).

Because only £3500 of my money is invested in the property and I’m making £6024 profit per year from the rental income after my costs, that means I’m achieving an ROI of £3500 divided by £6024 which is a 172% return on investment every year.

172% ROI is phenomenal compared to the stock market which returns about 10% ROI per year.

This really shows the power of property, when you do it right.

How Much Deposit for Buy to Let Mortgage?

In this year and with the current economy, you really need about £30,000 to get started in property and buy to let.

This allows you enough money to pay for a good deposit on a house in the north, and leaves you with cash to pay for stamp duty, legals and a small refurbishment to bring the property up to a fresh, clean standard.

You can of course, get cheaper – but if you’re investing your money, you’ll want to protect your investment right? So I do not recommend buying the cheapest house in the roughest area.

This means you won’t attract the right tenants that will look after your property, you won’t get good rents and you’ll have more overhead in maintaining the property or dealing with tenants who do not pay their rent.

By getting started with £30,000, you could realistically buy a property between £80,000 to £100,000 assuming you put down a 25% deposit on a 75% LTV mortgage.

£25,000 is an ideal deposit for a buy to let mortgage because it means you’ll be able to buy a good quality house, in a nice area which means you’ll attract good tenants and have less issues, thus protecting your investment. This also allows you the additional money for legals and purchase costs.

Of course, if you have more than £25,000 as a deposit for buy to let then definitely go higher as you’ll go up a scale of quality of house and area.

How To Get Started in Buy to Let

It’s tricky getting started. You don’t know where the best areas are to get started in buy to let. You don’t know which is the best property strategy to choose from.

It’s all confusing. What The Flip: Property Investing helps beginners just like you get started in the world of property and buying your very first property with the right strategy and knowledge to get started.

Check out my £0 to £100,000 journey and free workshop here

It can be daunting, not knowing whether you’re analysing properties properly, are you running the right numbers? I also have a property deal analyser to help you easily and quickly analyse property deals in an all in one solution.

The reality is, you have to take the time to learn about property, the strategies, how to analyse deals but at some point when you’ve taken all that information in. You just have to get started.

Choose a single area, and know what strategy you should get started with. Most property investors when starting out begin with a simple buy to let property. It’s lower risk, simpler and less can go wrong meaning your money can be better protected.

Go and view a few properties, get a feel for what it’s like to talk to estate agents, build relationships and learn what you should be looking for on your property viewings. This is all great experience and if you’ve got the money – take that leap.

I also offer property mentoring to help those a little unsure and you can check out loads of videos over at youtube.com/mattbrighton for free.

Is Buy to Let a Good Investment?

Buy to Let property can be incredibly rewarding if you do it the right way.

You could buy a super cheap property in a rough area of town and end up throwing your money away after having to deal with a lot of maintenance or even worse no payment of rent from the tenants.

However, if you buy a good home in a good area anywhere in the country, you’ll be able to make a healthy profit from your property while providing a family a safe, comfortable place to live.

They benefit from simply moving into a nice home and not inheriting any risk or cost with the upkeep of the property and you get to benefit from that rental profit every year for taking on the risk over time.

Property prices tend to double every 10 to 20 years and not only will you benefit from the rental income, you’ll also get the capital appreciation on the property so if you hold onto it for 20 – 30 years you’ll likely walk away with a really nice pension pot, plus that cashflow over time.

Or if you’re like me and you purchase buy to lets in a limited company, you can reduce your taxes by paying 19% corporation tax and then reinvesting the company profits back into the next projects to snowball your growth quicker.

Some of the wealthiest people in the world didn’t make their money through their business idea or side hustle, a lot of their wealth was generated through property.

Take Lord Sugar for example – he made money in phones and technology back in the 80s, however these days his money and wealth comes entirely from property – owning real estate in London.

Property is a great asset class in the UK, we live on a small island with increasing demand and lowering supply this means that demand will always be strong for a good house and prices will continue to rise.

Of course we will have property crashes, however in the long term property, based on history – has always gone up in price.

Can First Time Buyers, Buy to Let?

Yes! If you’re a first time buyer and you’ve never bought a home before, you can get a buy to let property.

It might be harder to do this through high street lenders as they usually want you to have bought your own home first but if you use a broker, they’ll be able to find a lender for you that isn’t bothered whether you own your own home or not.

I know many people who have bought a few buy to lets, before then buying their own home.

If you’re buying property in your own name, just remember that by purchasing a buy to let, you may have to pay a stamp duty surcharge because your actual first residential home, won’t be your first property and thus you’ll pay an additional 3% stamp duty.

Get out there, start viewing properties and begin your journey to becoming a buy to let landlord! The answer is Yes! Buy to let is definitely worth it!

10 Minute Read

10 Minute Read