Make £100,000s from property | Zero to Property Hero –

LOGIN:

⏱️ 13 minute read

📅 Written on July 31st 2020

Last Updated: 20th May 2022 @ 11:48am

Looking to get started as a property investor?

Work your way through our 6 part property investing guide for beginners

Part 2:

2022 Property Investment Strategies

Part 3:

Calculate Yield & ROI on Investment Property

Part 4:

Buying Property Through a Limited Company

Part 6:

How to flip a house as a property investor

Not working the numbers on a property, could be

Ok, maybe not that bad. But don’t make an expensive mistake you’ll

You must have seen it on ‘Homes Under The Hammer’?

Property novice goes into auction.

They pay WAY over the asking price and market value. Then overspend on the refurbishment.

Buying a property is meant to be one of the most stressful things you can do. But also extremely rewarding

Too many new property investors jump into their first deal WITHOUT understanding the numbers.

YOU DON’T NEED TO BE A

Knowing the numbers will make you a better investor than 80% of people out there. Seriously. It’s shocking!

In this guide, I’m going to show you how to work out all the property calculations you need.

You’ll learn:

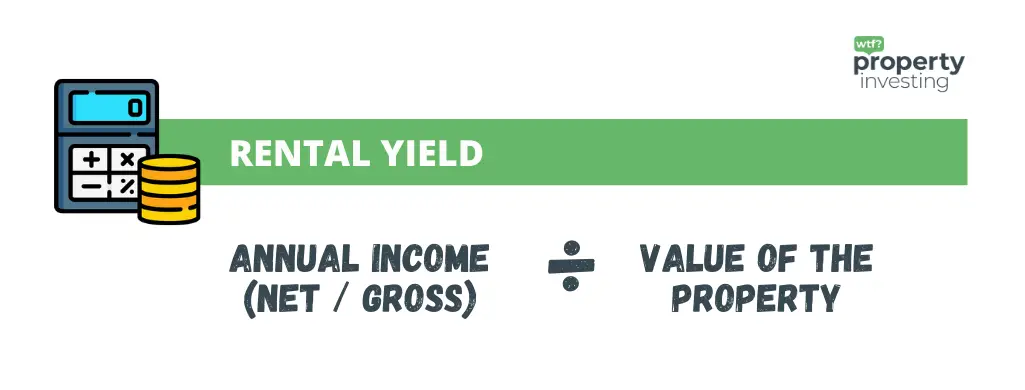

To calculate investment property yield will allow you to understand quickly whether a property you intend to rent out, is good or not.

We’ll look at GROSS YIELD and NET YIELD.

Calculating yield on a property is a way to understand quickly whether a property you intend to rent out, is good or not.

We’ll look at GROSS YIELD and NET YIELD.

Gross yield is the total annual rental income generated by the property, divided by the cost.

Let’s break that down:

It’s a good way for an ‘at a glance’ 👀 understanding whether a property is good or not.

But its also not the best way of looking at a deal. It completely ignores any costs you will encounter 🤷♂️ as a buy-to-let investor and landlord.

For example, mortgage costs. Management costs. Voids. Other expenses.

That’s where our good old friend. NET YIELD comes in.

To remember which way round GROSS and NET is, I have a great way 🤓.

Ok, so looking at our previous example. Lets now add costs to that as well to work out what our PROFIT is.

If the rent is £7000, minus the £2000 in costs. Our NET income is £5000.

There, that’s better!

Now we can see what the yield is, now we’ve factored in the costs.

Typical costs could include:

A good investor usually adds a rough % to account for all of these.

Property ROI… the holy grail of property calculations. 🙌

Return on Investment (ROI) is calculated by taking the annual NET income (GROSS minus costs), simply divided by all the money you’ve put in.

This figure is particularly useful when using a mortgage, as a large portion of the 🏡 house purchase, isn’t your own money.

Let’s break this down:

To understand another way of what ROI is telling you.

It means in one year, how much of your initial money 📈 you make back.

So if I invested £25,000. And made £5000 a year PROFIT.

It would take me 5 years to make all my money back (doubling it). Or 20%. 5 x 20 = 100.

This is one you’ve probably not heard of before. 🤔

It’s VERY similar to ROI / Return on Investment. But it’s more specific to the overall business. 💼

For example, if you had a bigger portfolio of multiple investments. Or in our case, properties. 🏘️

I see property investors confusing this, 🤷♂️ ALL THE TIME! Or thinking it’s the same thing. It’s really not. They use it on an individual property. Which is basically ROI.

I get they’re similar. But they have different uses.

On ROI we use the profit. For ROCE it uses something called EBIT. This stands for Earnings Before Interest & Tax. Big companies use it for understanding the return on capital employed.

Unlike the ROCE, ROI is a bit more flexible. It can be used to compare products, projects and various investment opportunities.

The downfall of ROI is that it doesn’t take the factor of time into account. An investment can have the same ROI and yet one can provide that return in a year. While another takes 2 years. The ROI calculation also doesn’t take into account fees or taxes, which are important for a company’s bottom line. 📊

If you had 5 properties, you wouldn’t use ROI to evaluate your entire portfolio or your business.

This is where ROCE comes in.

Let’s break this down

This means:

In your whole portfolio, you’re getting a 16% return every year. This is based on the cash tied up in the houses. Versus the rent, they generate as profit.

It’s a great way to summarise how your portfolio is performing for you as a whole.

Free Goal Setting Guide

Are you struggling to find focus in your property business? Do you have a clear, tangible and measurable plan of action? Download this free handy goal setting guide that explores wherey you are today, your financial literal and north star lateral goals – and what you need to do to bridge that gap to meet your goals.

Now we’re past the beginner’s bit. Let’s introduce some more advanced 🧠 thinking.

There’s a lot of debate out there around how you should truly calculate ROI. A novice investor may work out a rough profit. Some include a 10% maintenance⚒️. Some don’t.

As you can see, it’s quite subjective. 🤷♀️

Everyone has their own idea of what allowance to use for voids in a property. Similarly for maintenance/repairs.

Some investors use a lettings agent. Some self manage.

The key is being consistent as yourself to help you compare your own deals. If you see someone on Instagram boasting a 40% ROI. Remember they may have worked it out differently.

Get the latest scoop on what’s happening and say hello!

The ultimate way to get all of the latest ups and downs of property investing.

Learn from all my mistakes AND successes to help you create a property portfolio or optimise your existing one.

Get inspiration on slick interior design, all while mingling with like-minded investors.

See you on the other side.

Good question. And I shall answer it. ☝️

Let’s not forget about capital growth. And that’s just on your deposit, that’s on the entire property. 🔥

For example, if you invested £30,000 and got a 20% return. You’d have £36,000 after one year.

Put that £30,000 onto a house and you could purchase a property with a mortgage up to £120,000.

Let’s say you got a healthy 10% capital growth in a year on your property. That’s £12,000 capital growth just while the property EXISTS! Then you can factor in rental profits or flip gains. 🏡

Stop and think about that for a second.

And… that’s the beauty of investing in property. Compared to putting it into a bank at 1% a year. It’s a no brainer.

So you get capital growth PLUS the profits from rental income. As usual, there are no guarantees. A property could go down in value. So do your homework.

Speak to an accountant or tax professional to get proper advice.

This really depends whether you operate with property in your own name. Or through a limited company. It massively depends on how much you earn a year.

I’m a higher rate taxpayer. And I want to build a portfolio and use rental income to re-invest. For me, it makes sense to operate through a limited company. This means a very different tax treatment compared to owning property in your own name.

Tax is incredibly complicated, I’m by no means an expert. So I’d suggest speaking to a registered professional about your own personal affairs. 🧮

There are a few different ways to calculate your deals. I promise, if you use the above calculations. You are already ahead of most amateur property investors.

By understanding and using these, you’re showing business sense. Risk management. And financial understanding.

You’ll be able to better protect your money. And ensure it stretches and works harder for you.

Always remember there’s 3 calculations depending on what you’re strategy is.

There’s no hard and fast rule as to what determines a ‘good’ deal. That’s really for you to set.

You’re not likely going to find a 40% ROI on a small buy-to-let in Liverpool. Usually, 10% is the going average. But it also depends on what strategy you use.

I created a guide on making your property business plan and strategy. I highly recommend going through this to work out what’s best for you.

📮 No spam, ever. 📅 1 email a week. 👋 Unsubscribe anytime.

Goal Setting Guide

Pop in your email and I’ll send you the free guide!

Be a part of a supportive, wholesome group of like-minded people.