This guide looks at the stats, data and current affairs in the UK to look at a realistic scenario. To view my personal opinion, have a look at the last chapter at the bottom of this page!

🇬🇧 Is a UK Property Market Crash Possible?

If you’re wondering whether to buy or sell a house at the moment in this crazy market, then keep watching. In 2020 we were going through what we known as the mid-cycle wobble in the UK property market. A stage where some people get worried a property crash is on the Horizon.

Then… we experienced the largest pandemic the modern world has seen since and the UK property market was literally, frozen in time.

We all expected the market to tank, but what happened next was like nothing we’ve ever seen before. UK property prices surged more than 10% in one year and we’re currently experiencing the hottest market with 1 in 16 houses exchanging hands over the past year.

In this video we explore whether the UK is heading for a property crash or not, looking at the facts and data and understanding how history repeats its self.

More buyers are paying well over asking price, estate agents are resorting to last and final sealed bids and we’re seeing a slowdown of the UK’s capital, London with city dwellers wanting to escape the pollution and expensive housing in search of more bedrooms, safer areas and green space.

Going back to 2007 at the start of the last property crash, there’s still a lot of scars in recent memory for a lot of people.

The headlines in the news are incredibly confusing, you’ve got some headlines saying prices will continue to rise, and others saying that it’s time for the market to drop.

So what’s really going to happen?

🏡 UK Housing Market - What's happened so far

Low Interest Rates & Bank of England

Banks are throwing cheap money around left right and centre which is always the sign when an economy is strong and unemployment rates are low.

More people can afford higher amounts of credit due to lower rates, this happens because the Bank of England have lowered interest rates to 0.1% this means that banks don’t need to charge such high interest on mortgages to make enough margin and profit which is great for me and you because we get cheap mortgage interest rates.

The only downfall of this is that when we hold deposits with banks, like in savings accounts, that’s why we pretty much are losing money in the bank right now because it’s growing slower than what inflation is going up and is therefor worth less every year.

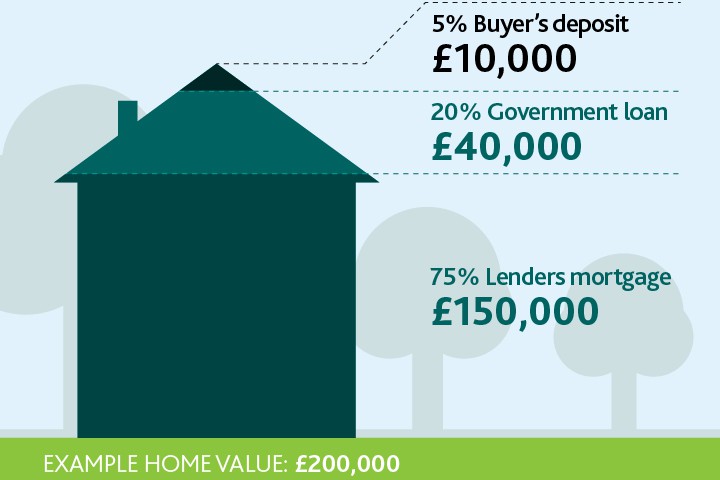

With low mortgage interest rates, more people can afford to get on the ladder with higher loan to value mortgages, this is where you pay a smaller % of your deposit and the bank provide a higher mortgage amount as a % of the property price. The average used to be about 75% Loan to value, meaning the bank provide 75% of the property price, but these days you can get mortgages as high as 95% or otherwise known as a 5% deposit mortgage.

Artificially Inflated Economy During the Pandemic

Although we had a complete property market stop in 2020, the furlough scheme kept the economy going, people could still spend money and be economically active, this meant that any major financial impacts of the pandemic weren’t really felt because most people were supported financially.

Although high street shops, pubs and restaurants had to stop, the ecommerce industry boomed, Amazon had one of it’s biggest years ever and we learnt how to adapt and work from home in an ever increasing online world.

Stamp Duty Holiday - After Effects

We then have the stamp duty holiday. Any homes up to a value of £500k had 0% stamp duty meaning that homebuyers could make a huge saving, this really pumped up people to move and buy a home while being able to save money on tax.

This worked really well for larger homes in the countryside which fuelled a huge run on larger properties with space. But the problem with this is that all the extra fuelled activity due to savings means that prices go up and people pay silly prices in sealed bids for properties, paying well over the actual value of the property.

Government Support for the UK Property Market

And lastly the government released their build build build plan to help reinvent the high street, completely rip up old planning laws and processes and make it easier for developers to take old commercial buildings and convert them back into residential use.

Every government we’ve had in my life, and I’m sure before then as well – have always failed to reach the housing targets we need for people in the UK. According to the office for national statistics we have 67 Million people living in the UK and about 28 million homes.

Naturally you can account for families living together but that would mean the average family would have to have 3 people per household which isn’t realistic when you factor in those who live on their own and as couples without kids.

With all of this hype, it turns out that half of the people who bought a house during the pandemic regret the price they paid. A lot of people got caught up in the whirlwind and paid silly prices.

I witnessed many auctions and property sales where old houses requiring £30k+ spending on them ended up selling for their done up value or even worse – higher than done up value and banks simply won’t lend on a house if it’s not worth it that people always forget.

📈 Hometrack House Price Index

Hometrack release a fantastic report every month, and we’ve seen over the past 12 months, Liverpool has had a 10.6% growth in price, Manchester at 8.7% and my stomping group Sheffield with 8% property prices.

Most towns and cities are now well above the old peak before the 2007 crash meaning properties have not only bounced back from the previous crash but they’re now at a higher baseline so the market is incredibly strong right now.

The Halifax house price index shows that House prices rise for fifth straight month with growth now at 15-year high

• Average UK property price hits a new record high of £272,992

• Quarterly house price inflation now at its strongest level since late 2006.

Comparing all of these awesome growth, London is only just above flat at 1% growth over the past 12 months.

🤷♂️ What's going to happen this year?

There’s something known as the 18 year property cycle coined by Fred Harrison. Harrison revealed his theory that housing prices follow an 18 year property cycle, and can be traced back to 200 years of peaks and troughs in land prices.

As well as the 2007 property crash, he also previously predicted the 1989 peak and the 1992 property recession, which coincides with the model. He used his theory of the 18 year cycle to forecast that there are 14 years of stability or growth after a crash, followed by 4 years of recession.

The cycle can also be broken up further into components of 7 years of slow, steady growth – then a mid cycle recession occurs, followed by 7 years of rapid growth. After the final two years of the fastest growth, the prices will crash and 4 years of recession will follow straight after.

With big companies like Lloyds Banking Group and John Lewis getting in on the property sector it’s a sign that there’s huge confidence in the market and that these huge UK companies are trying to diversify and boost their profits.

I used to work for Lloyds Banking Group and actually interviewed for one of their new Citra Living jobs to build their new portfolio.

Their aim is to add additional homes to already identified plots, so although they won’t be scooping up homes from first time buyers, they are trying to help fund homes that otherwise wouldn’t have been built but with a focus on the rental only market.

It’s not the best news for buyers, but it means that from a landlord, investor and buy to let perspective – if John Lewis and Lloyds Banking Group have huge interest and perspective on creating a rental portfolio then that’s a good sign.

🧠 My Personal Opinion - UK Housing Market Crash Likelihood

so, here’s my thoughts on the property market that follows the data, stats and trends.

Over the next few years we can expect to see property prices continue to increase, as the pandemic settles people will still be assessing what is the new norm for them.

Is it city life they want, which will put demand on flats and apartments in London, or is it space and peace that people want out in the countryside.

Either way both the London market and countryside market will continue to increase, at the moment we’re seeing huge annual gains in northern towns and cities which have lacked behind the past few years, completely smoking London which is climbing slower, a lot of that is down to the pandemic though, rather than anything specific to the property cycle.

With a few more years of growth, we’ll see the bank of england rate change a bit, which means stress testing your mortgage is crucial to make sure you can still afford repayments. But there will be increased confidence, we’ll see new headlines about the next biggest skyscraper in London, or next biggest construction project while confidence is high.

After 2025 I’ll be watching really closely as we’ll be somewhere near the peak of the cycle and that’s where paying over the odds and getting caught in the frenzy can hurt because as properties start to crash on average 15 – 20% if you’re already paying 5 – 10% over a properties value then you could end up in 30% negative equity on a property if you pay too much at the wrong point.

This is purely my view based on my understanding of the data and history, my best advice is enjoy the market for now, don’t be afraid to buy a home in the fear that it’s going to go down.

Historically property prices always go up over the long term so just make sure you don’t get into a fierce bidding war, pay a suitable price for a good property and ride the wave over the next few years.

If you’re buying a property for a long term investment anyway then you can’t go massively wrong, now is a great time to get in, the market is hot and at the moment waiting and holding off could actually cost you money as house prices continue to go up.

10 Minute Read

10 Minute Read