The UK is known for expensive housing, but we also have some cheap housing. It might not be pretty, but there have been famous headlines of £15,000 houses or even a street where homes sold for just £1.

Looking to buy a house in the UK but don’t want to break the bank? You’re in luck! There are plenty of affordable options, with some properties priced at just £15,000. Yes, you read that right. If you’re willing to put in a little work, you could own your own home for less than the cost of a new car.

According to Zoopla, the most affordable areas to live in the UK included Shildon in County Durham, where the average property price is just £71,000, and Cleator Moor in Copeland, where the average cost is £105,700.

Other affordable areas include Ferryhill in County Durham, Stevenston in North Ayrshire, and Cumnock in East Ayrshire. With prices like these, it’s no wonder that more and more people are considering buying property in these areas.

Of course, buying a cheap house comes with its own set of challenges. A house is cheap for a reason in the UK, be it the area, crime, street, or other factors. You’ll also have to think about the condition of the property.

You may need to invest time and money into renovating the property, and you’ll want to make sure the area is safe and has all the amenities you need. However, if you’re willing to put in the work, buying a cheap house can be a great way to get on the property ladder and start building your wealth.

Cheapest Houses In the UK

| # | Postcode | City/Town | Avg asking price |

| 1 | TS1 | Middlesbrough | £54,978 |

| 2 | BD1 | Bradford | £58,673 |

| 3 | SR1 | Sunderland | £65,478 |

| 4 | DN31 | Grimsby | £71,105 |

| 5 | DL4 | Shildon | £73,637 |

| 6 | TS3 | Middlesbrough | £80,958 |

| 7 | SR8 | Peterlee | £85,274 |

| 8 | DH9 | Stanley | £91,391 |

| 9 | BB11 | Lancashire | £91,516 |

| 10 | L20 | Liverpool | £91,793 |

| 11 | BD21 | Keighley | £91,833 |

| 12 | CH41 | Birkenhead | £91,885 |

| 13 | HU9 | Kingston upon Hull | £92,755 |

| 14 | SR5 | Sunderland | £93,222 |

| 15 | DL17 | Ferryhill | £95,380 |

| 16 | FY1 | Blackpool | £95,526 |

| 17 | HU3 | Hull | £97,043 |

| 18 | DN32 | Grimsby | £97,652 |

| 19 | L5 | Liverpool | £97,744 |

| 20 | TS25 | Seaton Carew | £100,603 |

RentRound used data from Propertydata to gather this information.

Understanding the UK Property Market

It’s important to understand the current property market. The pandemic has significantly impacted the property market, with property prices fluctuating and the process of buying a house becoming more challenging for some first-time buyers.

As many millennials are finding out and struggling, the UK property market operates on a property ladder system, where buyers start at the bottom and work their way up to more expensive properties. Property prices vary widely depending on the property’s location, size, and condition.

When buying a house, it’s important to have a budget, considering the deposit you’ll need to put down and any other associated costs. First-time buyers may need help getting on the property ladder due to the high deposit required and the rising property prices.

If you’re a first-time buyer, it’s important to do your research and understand the process of buying a house. You’ll also need to find a good solicitor (good ones are hard to find) and a good mortgage broker who can ensure you get a mortgage secured for the best rate available.

Overall, the UK property market can be challenging to navigate, but with the right knowledge and preparation, you can successfully buy a home that fits your budget and needs.

@nwpropertymum House price crash 2023? Is now a good time to buy for first time buyers? It comes down to personal circumstance and less about what is reported in the media. #homebuyertips #homebuyersecrets #homebuyereducation #firsttimebuyertips #firsttimebuyersecrets #firsttimehomebuyer ♬ Surf music that feels summer - SKUNK

Cheapest Areas in the UK for Property

If you want to buy a home in the UK, you may wonder where you can find the most affordable properties. Here are some of the cheapest areas in the UK for property.

Hull

Hull, located in the North East of England, is one of the cheapest places to buy a house in the UK. With an average house price of £121,000, you can find a property that fits your budget in this city. Hull is also a great place to live if you want a mix of rural and city-center living.

Sunderland

Sunderland, located in County Durham, is another affordable place to buy a home in the UK. With an average house price of £127,000, you can find a property that suits your needs and budget. Sunderland is also a great place to live if you are interested in living in a major UK city that offers a range of amenities.

Blackpool

Blackpool, located in Lancashire, is another affordable area to buy a home in the UK. With an average house price of £129,000, you can find a property within your budget. Blackpool is also a great place to live if you are interested in living near the beach and all the amenities that come with it.

Other affordable areas to buy a house in the UK include Peterlee, Bradford, Liverpool, Wallsend, Cleator Moor, and Cumnock. If you are interested in living in a rural location, plenty of options are available to you, such as County Durham, Copeland, and Lincolnshire.

When looking for the cheapest places to buy a house in the UK, it is important to consider factors such as the postcode, average property prices, and local amenities. You can find a property that meets your needs and budget by doing your research and exploring different areas.

Spotlight on North England and Scotland

If you’re looking for affordable houses in the UK, consider North England and Scotland. These areas offer some of the cheapest houses in the country, and they’re also known for their scenic beauty and friendly communities.

North England is a vast region that includes cities such as Newcastle and Sunderland. You can find houses in this region at prices significantly lower than the national average.

For example, according to The Times, you can buy a house in the North of England for as little as £800.

In Scotland, you can find affordable houses in areas such as North Ayrshire, East Ayrshire, and Ferryhill. These areas offer a range of properties at prices well below the national average. For example, according to Metro, the average house price in North Ayrshire is just £87,000.

When looking for a house in North England or Scotland, it’s important to consider your priorities. If you’re looking for a quiet, rural lifestyle, you should focus on areas such as County Durham, known for its beautiful countryside and friendly communities.

On the other hand, if you’re looking for a more urban lifestyle, you might prefer cities such as Newcastle, which offer a range of amenities and attractions.

Overall, North England and Scotland are great places to look for affordable houses in the UK. Whether you’re looking for a quiet rural retreat or a bustling city life, these areas have something to offer.

@propertytaxshow Will UK house prices go down in 2023? #uknews #housepricesuk #propertyinvestment #ukpropertymarket #housingmarket #propertyinvesting #ukpropertynews ♬ original sound - Provestor Accounts UK

Property Types and Prices

You’ll come across various property types if you’re looking for the cheapest houses in the UK. One of the most common types of affordable housing is the terraced house.

These houses are connected in a row, sharing walls on either side. Terraced housing is popular in urban areas and can be a great option for those looking to live close to the city center.

When it comes to prices, the cost of a terraced house can vary depending on the location and condition of the property. According to House Beautiful, the average property price in Shildon, County Durham, is just £71,000.

This makes it the most affordable town to buy a house in the UK. Other affordable areas include Cleator Moor in Copeland, Ferryhill in County Durham, and Stevenston in North Ayrshire.

If you’re willing to take on a refurbishment project, you may be able to find even cheaper properties. Zoopla lists ten homes for sale for £10,000 or less. These properties may require much work, but they can be a great investment for those looking to climb the property ladder.

Overall, the cheapest houses in the UK are likely to be terraced houses in affordable areas. However, it’s important to research and ensure you’re getting a good deal. Consider the property’s condition, location, and any potential refurbishment costs before making a purchase.

How to Get on the Property Ladder

Getting on the property ladder can be daunting, especially for first-time buyers. However, with the right approach and some planning, you can make your dream of owning a home a reality. Here are some tips to help you get started:

Work Out Your Budget

Before you start looking for properties, it’s important to work out your budget. This will help you determine how much you can afford to spend on a property and what type of mortgage you can get. Most mortgage providers will lend up to 4.5 times the amount you earn, so if you have a salary of £50,000 a year, you could borrow up to £225,000 if you have a deposit saved.

Saving for a Deposit

One of the biggest challenges facing first-time buyers is saving for a deposit. The bigger the deposit you can save, the easier it will be to get on the property ladder and the wider the choice of mortgages you’ll have available. The average deposit that a first-time buyer needs for a 95% mortgage in England is £11,087.

Investment Opportunity

Buying a house can also be seen as an investment opportunity. If you’re looking to buy a property as an investment, consider the potential rental income and the long-term capital growth of the property.

Online Auction

Online auctions are becoming increasingly popular for buying and selling properties. They offer a quick and easy way to purchase a property, and you can often find great deals. However, it’s important to research and ensure you understand the process before you start bidding.

Buying a Home

Buying a home is a big decision; taking your time and research is important. Make sure you view a property before making an offer, and consider the property’s location, size, and condition before you commit to buying.

Deposit

When you’re ready to make an offer on a property, you’ll need to have a deposit ready. This is usually around 5-20% of the property’s value, depending on the type of mortgage you’re getting.

Remember, getting on the property ladder takes time and effort, but it’s a worthwhile investment in your future. By following these tips and researching, you can make your dream of owning a home a reality.

The Impact of Covid-19 on House Prices

The Covid-19 pandemic has had a significant impact on the UK housing market. The uncertainty caused by the pandemic has led to a slowdown in the property market, with many buyers and sellers delaying their transactions.

However, despite the initial slowdown, the UK housing market has remained resilient, with house prices rising.

According to the Office for National Statistics, the average house price in the UK increased by 8.9% in the year to April 2021. This is the highest annual growth rate recorded since 2014. The pandemic has caused a shift in demand for larger properties with outdoor space, as more people are working from home and spending more time indoors.

The pandemic has also led to changes in the way people view properties. Virtual viewings have become more popular, allowing potential buyers to view properties without leaving their homes.

This has increased the number of people looking for properties outside their local area, as they can now view properties further afield without traveling.

Despite the rise in house prices, the pandemic has also harmed housing affordability. Many people have lost their jobs or have had their income reduced, making it harder for them to get onto the property ladder. This has led to an increase in demand for affordable housing, particularly in urban areas.

Additional Costs to Consider

When looking for the cheapest houses in the UK, it’s important to consider the additional costs of buying a property. Here are some of the costs you should keep in mind:

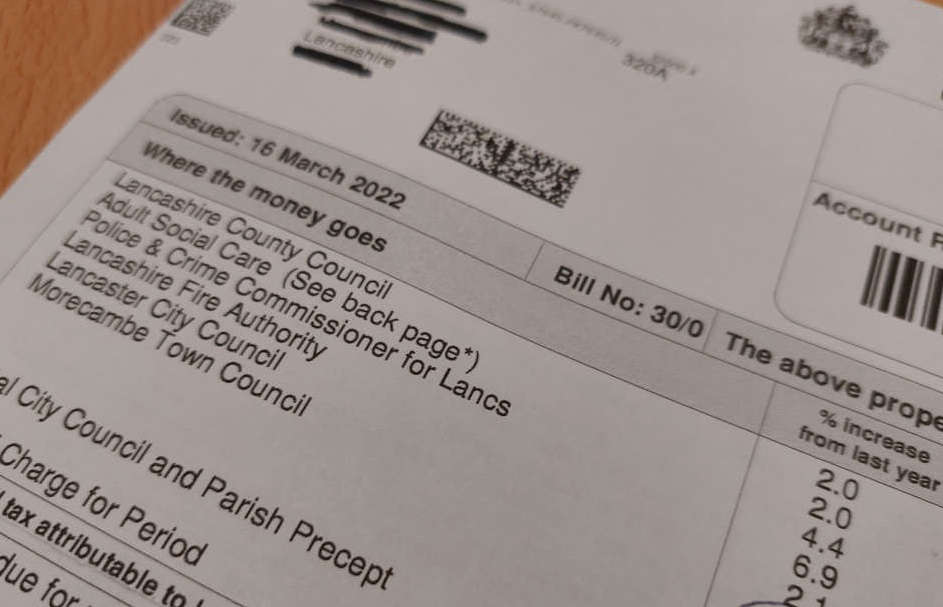

Council Tax

Council tax is a tax on domestic properties that local authorities charge to pay for local services. The amount you’ll pay depends on the value of your property and the area you live in. It’s important to factor in council tax when budgeting for a property, as it can be a significant expense. You can find out how much council tax you must pay by contacting your local council.

Refurbishment

If you’re buying a cheap property, it will likely need some work done. Refurbishment costs can quickly add up, so factoring this into your budget is important. Before buying a property, it’s a good idea to get a survey done to identify any potential issues that may need addressing. This will help you to get a more accurate picture of how much money you’ll need to spend on refurbishment.

Shared Gardens

If you’re buying a property with a shared garden, it’s important to consider the costs of maintaining it. You may need to contribute to gardening services or pay for necessary repairs.

Make sure you find out the arrangements for maintaining the garden before buying the property.

Overall, when looking for the cheapest houses in the UK, it’s important to remember that there may be additional costs to consider. You can avoid any unpleasant surprises by factoring in these costs and budgeting accordingly.

The Role of Online Platforms in Property Search

Online platforms have become an essential tool for homebuyers when searching for the cheapest houses in the UK. In fact, according to a survey conducted by Halifax, 90% of homebuyers used online platforms during their property search.

One of the most popular online platforms for property search is Zoopla. Zoopla provides a comprehensive search engine that allows you to filter your search by price, location, number of bedrooms, and more. You can also set up email alerts to be notified when new properties that match your criteria become available.

Instagram has also become a popular platform for property searches. Many estate agents and property developers use Instagram to showcase their properties. By following estate agents and searching relevant hashtags, you can find hidden gems that might not be listed on other platforms.

However, it’s important to remember that not all properties on Instagram are affordable. Do your research and check the prices before getting too excited.

Halifax, a UK-based bank, also has its online property search platform. The platform provides various tools to help you find the cheapest houses in the UK, including a mortgage calculator and a home affordability calculator.

Overall, online platforms have revolutionized the way we search for properties. They provide us with a wealth of information and make finding affordable houses in the UK easier. Whether you’re using Zoopla, Instagram, or Halifax, do your research and take advantage of all the available tools.

Expert Insights

If you’re looking for the cheapest houses in the UK, getting insights from experts in the field is essential. Grainne Gilmore, Head of Research at Zoopla, has been tracking the UK’s property market for years and has some valuable insights to share.

According to Gilmore, the North East of England is one of the most affordable regions in the UK, with average house prices around £126,000. In contrast, London has the highest average house prices, with the average property costing around £655,000.

However, Gilmore notes that affordability is not the only factor to consider when buying a house. It would help if you also considered factors such as job opportunities, transport links, and local amenities.

Gilmore also notes that the COVID-19 pandemic has affected the UK’s property market, with demand for larger homes with gardens increasing. However, she cautions that the market remains unpredictable, and it’s essential to do your research before making any decisions.

When buying a property, Gilmore advises you to always complete a survey before making an offer. This will help you identify any potential issues with the property, such as damp or structural problems, that could cost you a lot of money in the long run.

Overall, if you’re looking for the cheapest houses in the UK, it’s essential to do your research and get insights from experts like Grainne Gilmore. While affordability is vital, it’s also important to consider other factors, such as location and the property’s condition.

Frequently Asked Questions

What is the cheapest place to buy a house in the UK?

According to recent data, the cheapest place to buy a house in the UK is Middlesbrough, with an average house price of £54,978. Other affordable areas include Bradford, Sunderland, Grimsby, and Shildon.

Where can I find the cheapest homes in the UK?

You can find the cheapest homes in the UK in areas like Middlesbrough, Bradford, Sunderland, Grimsby, and Shildon. It’s also worth checking out auction houses, as they often sell properties at discounted prices.

Which UK county has the most affordable property?

County Durham is currently the most affordable county in the UK regarding property prices. Other affordable counties include Lancashire, Merseyside, and South Yorkshire.

What are the cheapest houses available to rent in the UK?

The cheapest houses in the UK can be found in areas like Sunderland, Blackpool, and Middlesbrough. However, it’s important to remember that rental prices vary greatly depending on location and property type.

Are there any abandoned houses available for free in the UK?

While there have been cases of abandoned houses being given away for free in the UK, these instances are rare. It’s important to note that even if a property is left, it may still have legal owners, and you should only attempt to take possession of it with proper legal guidance.

Where can I find the cheapest houses for sale in the UK?

You can find the cheapest houses for sale in the UK in areas like Middlesbrough, Bradford, Sunderland, Grimsby, and Shildon. It’s also worth checking out auction houses and property auctions, as they often sell properties at discounted prices.

10 Minute Read

10 Minute Read