@organiseyourmoney_oym Martin Lewis Life Insurance For Inheritance Tax… #mortgage #lifeinsurance #martinlewis #ukeconomy #uklifeinsurance #financialeducation #financetiktok #inheritancetax #finacialliteracy ♬ Polozhenie - Izzamuzzic Remix - Скриптонит

If you’re worried about leaving a large inheritance tax bill for your loved ones, there are legal ways to reduce or avoid it altogether. Inheritance tax is a tax on the estate of someone who has died, and it can be a significant expense if you don’t plan.

This article will explore the most effective ways to avoid inheritance tax and ensure your estate goes to your beneficiaries instead of the taxman.

Understanding inheritance tax is the first step to avoiding it. In the UK, inheritance tax is 40% on estates valued over £325,000.

However, certain exemptions and allowances can reduce the tax bill. For example, you can make gifts to your loved ones during your lifetime, leave money to a charity, or use property allowances to reduce the value of your estate.

Understanding these options is essential to make informed decisions about your estate planning.

Legal ways to avoid inheritance tax include gifting assets, setting up trusts, and passing your house on to your children.

However, seeking professional advice before making any decisions is essential, as strict rules and regulations surround these options.

With the proper guidance, you can ensure that your estate is distributed according to your wishes and that your loved ones can handle the unexpected tax bill.

Key Takeaways

- Understanding inheritance tax is the first step to avoiding it.

- Legal ways to avoid inheritance tax include gifting assets, setting up trusts, and passing your house on to your children.

- Seek professional advice before making decisions to ensure your estate is distributed according to your wishes.

Understanding Inheritance Tax

Inheritance tax is a tax on the estate of someone who has passed away. The estate includes all the property, money, and possessions the person owns. The tax is usually paid out of the estate before any funds or assets are distributed to the beneficiaries.

In the UK, inheritance tax is currently charged at a rate of 40% on the value of an estate above a certain threshold. The threshold is currently set at £325,000, which means that if the value of your estate is less than this, there will be no inheritance tax to pay.

However, if the value of your estate exceeds the threshold, then inheritance tax will be charged on the amount above the threshold. For example, if the value of your estate is £400,000, then inheritance tax will be charged on £75,000 (£400,000 – £325,000).

It’s important to note that inheritance tax is usually only paid on property inheritance. This means that you will not usually have to pay inheritance tax if you inherit money or assets that are not property, such as shares or a car.

Understanding how inheritance tax works is an essential part of estate planning. By taking steps to reduce the value of your estate, you can potentially reduce the amount of inheritance tax that will be payable on your death.

Legal Ways to Avoid Inheritance Tax

When it comes to avoiding inheritance tax, there are some legal ways to do so. The following methods can help you reduce the amount of inheritance tax you owe:

Make a Will

One of the simplest ways to avoid inheritance tax is to make a will. This allows you to ensure that your assets are distributed according to your wishes.

Without a will, your assets will be distributed according to intestacy rules, making your estate liable to inheritance tax that could have otherwise been avoided.

Make Gifts

You can gradually reduce the size of your taxable estate by making gifts during your lifetime. However, the rules surrounding these are complex, and not all gifts will minimize inheritance tax in all circumstances. You can gift up to £3,000 in a single tax year and carry forward unused exemptions from the previous year.

Use Property Allowances

You can use property allowances to reduce your inheritance tax liability if you have a property. The Residential Nil Rate Band (RNRB) allows you to pass on a property worth up to £1 million to direct descendants without paying any inheritance tax.

Consider Equity Release

Equity release is a way of accessing the value of your home without selling it. It can be a helpful way of providing funds for your retirement or to pass on to your heirs.

However, it is essential to note that equity release can affect your inheritance tax liability.

Take Out a Life Insurance Policy

Another way to reduce your inheritance tax liability is to take out a life insurance policy. This can provide a lump sum payment to your heirs, which can be used to pay any inheritance tax due.

Consider a Deed of Variation

A Deed of Variation allows you to change the distribution of an estate after someone has died. This can be useful if you want to reduce the amount of inheritance tax that needs to be paid. However, it is important to note that a Deed of Variation must be executed within two years of death.

Gifting Assets

If you want to reduce your inheritance tax bill, gifting your assets to your loved ones can be a good option. However, you need to follow some rules and guidelines to ensure your gifts are exempt from inheritance tax.

One of the most straightforward ways to gift your assets is to give them away during your lifetime. This can help reduce the value of your estate and, in turn, the amount of inheritance tax your beneficiaries will have to pay.

However, there are some rules you need to follow when giving your assets away:

- You must live for at least seven years after making the gift for it to be exempt from inheritance tax.

- You must refrain from continuing to benefit from the asset after giving it away. For example, if you give away your home, you cannot continue to live in it rent-free.

- You must be sure that you will not need the asset. Once you give it away, you cannot get it back.

It’s important to note that some gifts are exempt from inheritance tax regardless of when they were made.

For example, you can give up to £3,000 away each tax year without being subject to inheritance tax. You can also give gifts of up to £250 to as many people as you like each tax year.

If you’re considering gifting your assets, speaking to a professional financial advisor or solicitor is a good idea.

They can help you understand the rules and regulations around gifting and ensure you make the right decisions for you and your family.

Remember, gifting your assets is one way to reduce your inheritance tax bill. Other options, such as setting up a trust or making charitable donations, are available.

It’s important to consider all of your options before making any decisions.

Setting Up Trusts

Setting up a trust can be a helpful strategy if you’re looking to avoid inheritance tax.

Trusts can help you control what happens to your assets after you pass away, and they can be a tax-efficient way to pass on your wealth to your loved ones.

There are different types of trusts you can set up, but two of the most common are Discretionary Trusts and Interest in Possession Trusts.

Discretionary Trusts

A Discretionary Trust is a type of trust where the trustees have discretion over distributing the trust’s assets to the beneficiaries. This means that the trustees can decide who gets what and when.

This can be useful if you want to leave your assets to your children or grandchildren, but you’re still determining how much or when they’ll need it. By setting up a Discretionary Trust, you can ensure that your assets are distributed in a way that’s fair and appropriate.

Interest in Possession Trusts

An Interest in Possession Trust is a type of trust where the beneficiary has a right to the income from the trust’s assets but not the assets themselves.

This means that the beneficiary can receive the payment from the trust’s assets during their lifetime, but they don’t have control over them.

This can be useful if you want to provide for a spouse or partner after you pass away but you’re concerned about them remarrying or leaving the assets to someone else.

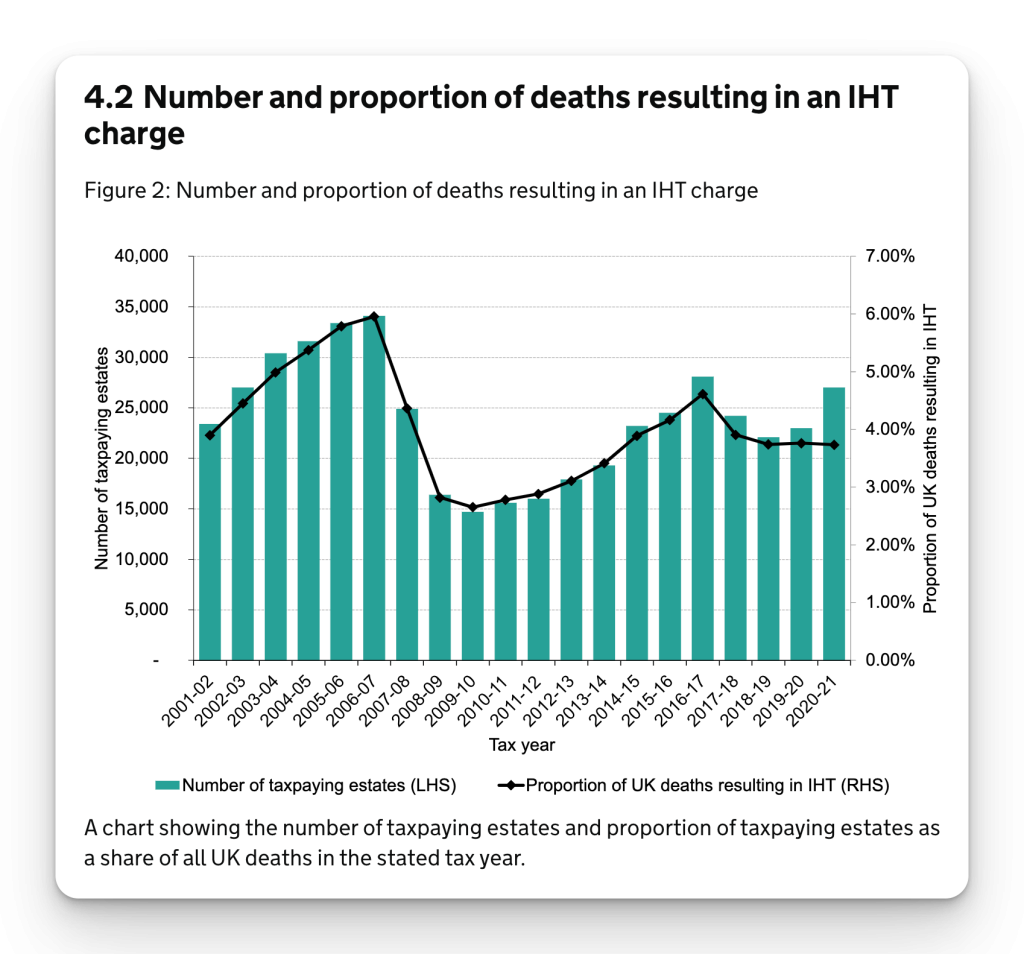

Inheritance tax is paid by 3% of estates

— nazir afzal (@nazirafzal) September 23, 2023

The beneficiaries of any cut are the richest people in the U.K. including the PM & most of his Govt

Meanwhile, the tax burden on the rest of us is the highest it’s been since WW2

When they show you who they are, they’re not on your side pic.twitter.com/GI6UREWizq

Property Trusts

If you own property, setting up a property trust can be a tax-efficient way to pass on your property to your loved ones. There are different types of property trusts you can set up, such as a Life Interest Trust or a Discretionary Trust.

A Life Interest Trust is a type of trust where the beneficiary has the right to live in the property for the rest of their life, but they don’t own the property. This can be useful if you want to provide for a spouse or partner after you pass away but are concerned about them selling the property or leaving it to someone else.

A Discretionary Trust, as mentioned earlier, is a type of trust where the trustees have discretion over how to distribute the trust’s assets to the beneficiaries.

This can be useful if you want to leave your property to your children or grandchildren, but you’re still determining how much they’ll need or when they’ll need it.

Setting up a trust can be complex, and seeking professional advice is essential before making any decisions.

A financial planner or solicitor can help you understand the types of trusts available and which is suitable for you. They can also help you set up the trust and ensure that it’s structured in a tax-efficient way.

Passing My House Onto Children

If you are considering passing your house on to your children, knowing the potential inheritance tax implications is crucial.

Inheritance tax is a tax on the estate of a person who has passed away, and it can be a significant amount for those with valuable assets such as a house.

Fortunately, there are ways to mitigate the potential inheritance tax liability when passing your house to your children. Here are some options to consider:

- Make use of the residence nil-rate band: This is an additional allowance that applies to your home’s value when passed on to your children. In the 2023/24 tax year, this allowance is £175,000 per person. This means that if your estate includes a property worth less than £1 million, your children may be able to inherit it without paying any inheritance tax.

- Gift your property: If you gift your property to your children, it will be treated as a potentially exempt transfer for inheritance tax purposes. This means that if you survive for at least seven years after making the gift, the property’s value will not be included in your estate for inheritance tax purposes.

- Consider a trust: Consider setting up a trust to hold your property for the benefit of your children. This can be a complex area, and it is crucial to seek professional advice before proceeding.

It is important to note that passing your house onto your children may have other implications, such as affecting your entitlement to means-tested benefits. It is essential to consider all aspects before making a decision.

In summary, passing your house onto your children can be a tax-efficient way of transferring wealth, but it is essential to consider the potential inheritance tax implications and seek professional advice.

By using the residence nil-rate band, gifting your property, or considering a trust, you can mitigate the potential inheritance tax liability.

7 Year Inheritance Tax Loophole

One of the simplest ways to avoid paying inheritance tax (IHT) is to spend your money or give it away during your lifetime. No tax is due on any gifts you give as long as you live for seven years after giving them. This is known as the 7-year inheritance tax loophole.

This loophole allows you to give away assets worth up to £325,000 without incurring any inheritance tax. If you give away more than this amount, you may be liable for inheritance tax if you die within seven years of making the gift.

However, using a sliding scale, you can reduce the amount of inheritance tax payable on gifts made within seven years of your death. This means that the longer you live after making the gift, the less inheritance tax will be payable on it.

Focus on property and housing if you want to pass your wealth down to your children. You can give away your home or a share of it to your children and avoid inheritance tax, as long as you live for seven years after making the gift.

This is known as a gift with reservation of benefit.

In summary, the 7-year inheritance tax loophole is a simple and effective way to avoid paying inheritance tax.

Giving away assets during your lifetime can reduce the inheritance tax payable on your estate and ensure that your wealth is passed down to your loved ones.

Conclusion

Inheritance tax can be a significant burden on your estate and your beneficiaries. However, there are several strategies that you can use to reduce or avoid your inheritance tax liability.

One of the most effective ways to avoid inheritance tax is to make gifts during your lifetime. You can make gifts of up to £3,000 per year without incurring any tax liability. You can also make gifts to your spouse or civil partner, charities, or political parties without incurring any tax liability.

Another way to avoid inheritance tax is to use trusts. Trusts can be used to hold assets for the benefit of your beneficiaries, and they can be structured in a way that minimizes your inheritance tax liability.

You can also consider taking out a life insurance policy to cover your inheritance tax liability. This can be an effective way to ensure that your beneficiaries receive the full value of your estate without paying any inheritance tax.

Finally, it’s essential to seek professional advice when planning your estate. A financial adviser or solicitor can help you to develop a strategy that minimizes your inheritance tax liability while ensuring that your assets are distributed according to your wishes.

By taking advantage of these strategies, you can reduce or even eliminate your inheritance tax liability, leaving more of your estate to your loved ones.

10 Minute Read

10 Minute Read