Rich Dad Poor Dad Summary

Why do the rich get richer? What is it that the rich are doing that the middle class and poor do not? People say that they’re not interested in money, but they’ll work at a job for eight hours a day just to pay the bills or that they’d rather have a safe, secure job.

If there’s one book that changed my life and my perspective on personal finance. Then Robert Kiyosaki’s rich dad poor dad is the one that you should read and learn from, for me, it has changed how I think forever about money.

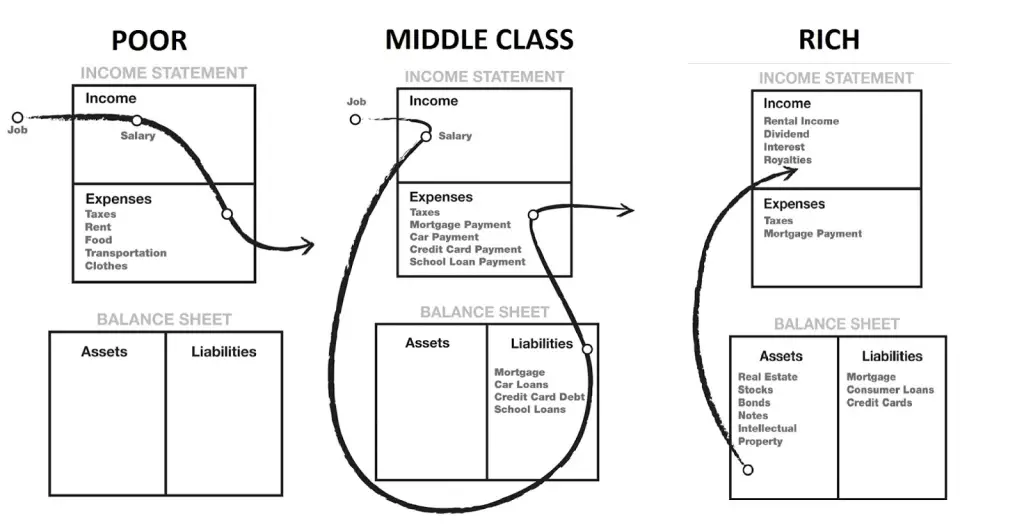

To some, it may be obvious of how to manage an asset and a liability. Robert simply teaches in the book that Assets put money in your pocket, and a liability takes money out of your pocket. And once you understand this, you can invest your money into assets which pay for liabilities and luxuries, rather than just spending your money straight into fancy cars, the latest iPhone or new clothes.

Rather than saying ‘I cant afford this’ the question should be ‘how can I afford this?’ and rich people find a way to make it happen. Ultimately you want to be in a position where money works 24 hours a day for you, rather than you working 24 hours a day for money!

🚀 The Book in 3 Sentences

- 1. Rich Dad Poor Dad is about Roberty Kiyosaki and his two dads – his real father (poor dad, well educated and working in the corporate world for someone else) and the father of his best friend (rich dad) – both fathers had very different views of the world and they shaped his thoughts about money and investing.

- 2. You don’t need to earn lots or have a high income to be rich. Wealth is about how long you can last if that income stopped. EG. a high paid corporate person on 6 figures won’t last long if they have a huge mortgage, expensive car and high outgoings.

- 3. Rich people buy assets, not liabilities. They use the income from their assets to fund their liabilities. So when you hear somebody saying they have nice assets like a range rover on the drive. Their perspective of finance is all wrong.

🎨 Rich Dad Poor Dad Review & Summary

The book is incredibly eye opening. To some, this may be obvious and the teaching around how to manage your assets and liabilities may be simple knowledge. But to those of you (and me) who didn’t really think this way before without realising… it’s mind blowing but so obvious at the same time.

The teachings around understanding how to invest your money into assets which fund your lifestyle have changed how I think forever, so for example if you wanted to finance a brand new car, rather than just paying for this monthly out of your salary. Instead if you have a pot of cash, invest into an asset first like a house which pays rent every month. You then use the profits from the rent, to pay for the car.

That way your money gains value in the form of the price of the property – whilst the extra cashflow pays for the luxuries. This way you ensure that you’re growing your money, rather than spending it all.

Secondly, another great mindframe is to re-think how you talk about money and buying items.

If you want to buy that shiny new iPhone, pair of noise cancelling headphones or brand spanking new 4k camera to make your YouTube videos look sick then

Rather than saying ‘I cant afford this’ the question should be ‘how can I afford this?’ and rich people find a way to make it happen. They create a plan and work out a way to finance and pay for something.

The first steps to building wealth is understanding and accepting that it lies with a mindset in taking risks. The rich manage risks instead of avoiding them. Put a small amount of money aside, it doesn’t have to be huge and treat that money with the mindset as if it’s gone forever. That way it will change your perception of risk.

You should focus on paying yourself first. As you can begin to generate income generating assets – you can ensure that you pay yourself first, manage your expenses and THEN the taxman gets his hands on what’s left. Rather than what you get upfront.

This is why having a corporation or business is crucial, to help manage your wealth.

This is why the rich, get richer. As their assets and income more than cover their expenses and liabilities – the leftover balance is re-invested, so that income and wealth is evergrowing.

There’s no rush, and it’s never too late. Just stay at your full time job and focus on putting aside to grow that asset column.

Build your business on the side and eventually, with the help of compounding – you’ll find that this income begins to exceed your job income. By ensuring that you pay yourself first, you’ll find that you need less overall income to have the same amount of money left – that’s because it’s taxed last.

The general population are run by two emotions fear and greed which puts us in a pattern of get up, go to work and pay bills. Fear puts people in a trip of working. Instead of confronting the fear – we react with emotion.

There’s desire (greed) – this is why people work for money. We work for the joy we think it can buy, but the joy that it brings is short lived and we need more money for more joy, more pleasure and more comfort.

That’s why people are fanatical about going to school, getting a steady job and working hard for someone else.

You should be learning to use your emotions to think. NOT think with your emotions. Have you ever told yourself:

💪 I need to get another job

💸 I deserve a raise

🔐 I want this job because it's secure

Instead of:

Is there something i’m missing here?

If you apply the lessons to your life that your assets should be your income, not your profession this is the start of a path to generating wealth.

Should I Read Rich Dad Poor Dad?

Lots of people in the property investors community were talking about it. It’s the book that got a lot of property investors started and taught people the power of investing and especially by using a limited company which comes with tax benefits to manage your wealth.

Anyone who is interested in personal finance and building wealth. The book doesn’t teach you how to become rich in terms of strategies – it focuses purely on the financial, tax and business side and regardless of what you do to make money – it teaches how you should be operating to manage that money and build your wealth that way – through assets.

☘️ How the Book Changed Me

- The rich don’t work for money – Rich people don’t work by the hour or for someone else.

- They build a system or a process and hire people to manage that process for them. That’s what a business is and that’s how you become rich. When you think about McDonalds, it’s not about selling burgers and fast food.

- McDonalds is simply a very efficient system of serving food very fast. If you’ve ever read books about McDonalds or watched the film ‘Founder’ released in 2016, they meticulously tried and tested how to lay out the kitchen to make it more efficient. But at the end of the day McDonalds is purely a system that somebody built and most of the McDonalds wealth is also from the land they own, rather than the food they sell. Go figure that one out.

- The other thing that the book taught me is the power of corporations and limited companies in the UK – In my 9-5, most of my money is taxed and money is given to the government before it gets to me – I only get what’s left.

- If you operate within a corporation or a business then you can buy everything you need first, and only THEN does the rest go to the tax man. This means you can lower the amount of tax you spend thus requiring less money to aquire the same amount of wealth.

There are five big ideas with this book that really resonate with me:

1. The poor and middle class work for money. The rich have money work for them

- 2. It’s not how much money you make that matters. It’s how much money you keep

- 3. Rich people aquire assets. The poor and middle class acquire liabilities that they think are assets.

- 4. Financial aptitude is what you do with money once you make it, how you keep people from taking it from you, how to keep it longer and how you make money work harder for you.

- 5. The single most powerful asset we all have is our mind.

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

Robert Kiyosaki Tweet

10 Minute Read

10 Minute Read