Interest Rates on most UK mortgages are expected to peak at around 6.5% to 7% dependent on whether you have product fees or not, before coming down.

The bank of england are expected to keep the bank rate between 5 to 5.5% until 2024 and then begin slowly reducing this rate. A lot of banks have already priced in the rises.

This is a big shock for a lot of people who fixed on 2% mortgages pre pandemic and are now facing huge rises in mortgage costs, causing people to sell homes and downsize after stretching their finances a bit too far.

2023 saw incredible interest rate rises; the looming problem is that many people fixed their two-year mortgages just after the pandemic after the mini housing boom and surge in property activity.

Then, with the bank rate increasing, many people are coming off their fixed-rate mortgages to higher rates, which makes a difference of hundreds of pounds a month.

If you’re a homeowner, you may wonder how much your mortgage will go up. There are a few factors that can affect your mortgage payments, including changes in interest rates, changes to your property taxes, and changes to your insurance premiums.

Interest rates are one of the most significant factors affecting your mortgage payments. If interest rates rise, your monthly payments will go up, and vice versa. This is because the interest rate determines how much you’ll pay in interest each month, which is added to your principal balance.

If you have a fixed-rate mortgage, your interest rate won’t change over the life of your loan, but if you have an adjustable-rate mortgage, your interest rate can fluctuate over time.

Understanding Mortgage Rates

When you take out a mortgage, you’ll be charged interest on the amount you borrow. This interest rate will determine how much you pay each month, and it can significantly impact your overall repayments.

Understanding mortgage rates is essential to make informed decisions about your borrowing.

Fixed Rate Mortgage

A fixed-rate mortgage is a product where the interest rate remains unchanged for the entire loan term. This means that your monthly repayments will stay the same, regardless of any changes in interest rates.

Fixed-rate mortgages are popular because they offer stability and predictability, which can be helpful when budgeting.

However, in the UK they typically only last for 2, 3, 5 or 10 years which is very different to our friends in the US who can normally fix a mortgage for 20 – 30 years.

Variable Rate Mortgage

A variable rate mortgage is a type of mortgage where the interest rate can go up or down over time. This means that your monthly repayments can also go up or down. Variable-rate mortgages are often cheaper than fixed-rate mortgages, but they can be riskier because you don’t know how much you’ll pay each month.

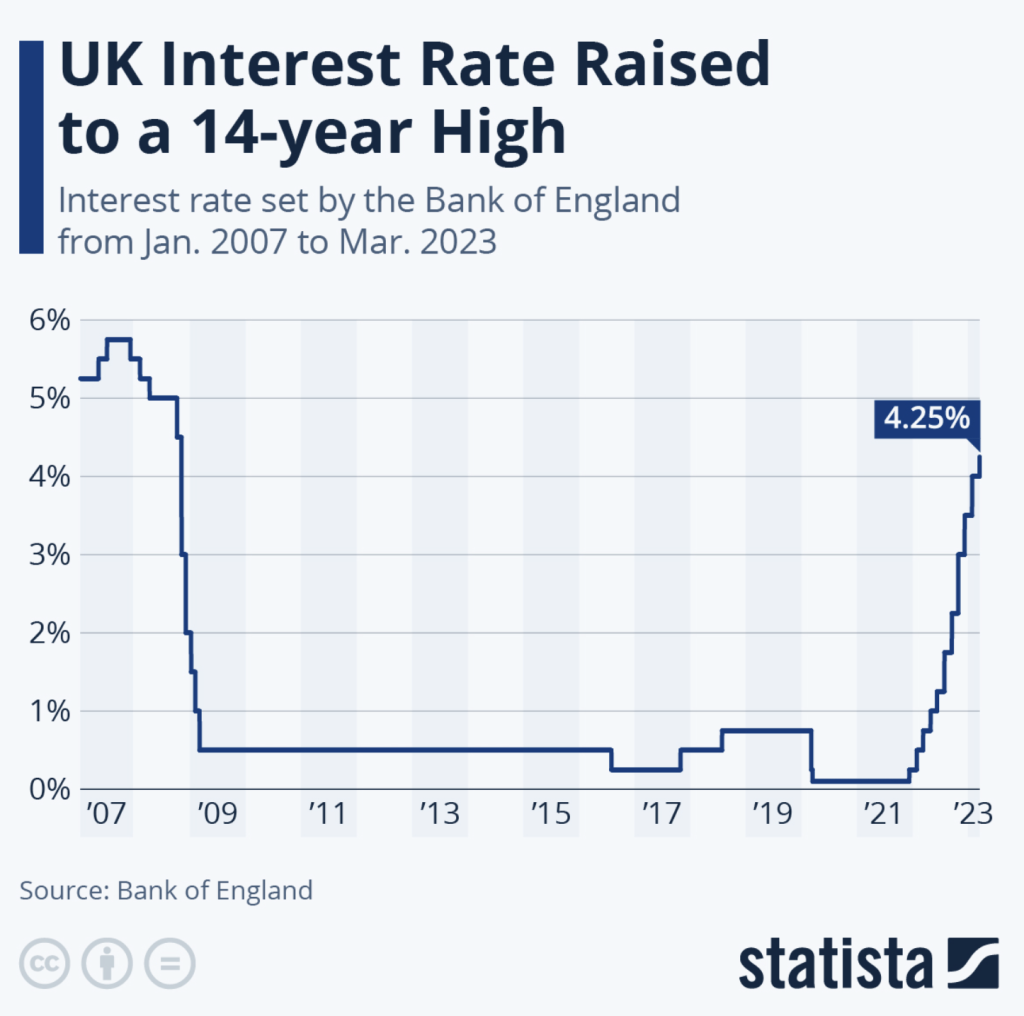

If you have a variable-rate mortgage, your repayments will be affected by changes in the Bank of England base rate. In 2022 and 2023 we saw interest rates go from 0.1% to 5.25% (with room to still go higher after posting this). So that has been a massive shock for mortgage payers.

Interest Rate Increases in 2023

Interest rates have increased in recent years due to several factors, including inflation and economic growth. If you have a variable-rate mortgage, your repayments may have increased. However, it’s important to remember that interest rates can also go down, so your repayments may also decrease.

When taking out a mortgage, it’s important to consider all your options and consider what will work best for your budget and financial goals.

Whether you choose a fixed-rate mortgage or a variable-rate mortgage, make sure you understand how your repayments will be affected by changes in interest rates.

Factors Influencing Mortgage Increase

When you take out a mortgage, the amount you pay each month can change over time. Several factors can cause your mortgage to increase, including changes in interest rates, property value, and lender’s mortgage insurance.

Interest Rate Changes

One of the most significant factors that can cause your mortgage to increase is changes in interest rates. If the Bank of England increases the bank rate, this can cause your lender to increase the interest rate on your mortgage. You must pay more each month to cover the higher interest rate.

To help mitigate the impact of interest rate changes, consider fixing your mortgage rate. This means that your interest rate will stay the same for a set period, regardless of any changes to the bank rate.

Changes in Property Value

Another factor that can cause your mortgage to increase is changes in property value. If the value of your property increases, this can lead to higher mortgage payments. This is because your mortgage is based on a percentage of the property value, so if the value goes up, your mortgage payments will, too.

On the other hand, if the value of your property decreases, this can lead to lower mortgage payments. However, it’s important to note that if the value of your property drops significantly, you may end up in negative equity, which means you owe more on your mortgage than your property is worth.

Calculating Mortgage Increase

If you’re wondering how much your mortgage will increase, you can use either a mortgage calculator or a manual calculation. Both methods will give you an estimate of the increase in your monthly payments.

Using Mortgage Calculators

Mortgage calculators are a quick and easy way to estimate your monthly payments. Most mortgage calculators will ask for your current mortgage balance, interest rate, and the years left on your mortgage.

Once you input this information, the calculator will estimate your new monthly payments based on the increased interest rate.

It’s important to note that mortgage calculators only provide estimates. Your monthly payments may differ depending on your lender’s specific policies and terms.

Manual Calculation

- Take the outstanding amount owed on your mortgage and multiply that number by your current interest rate as a decimal. For instance, 2% would be 0.02, or 5.5% would be 0.055.

- Divide that number by 12, giving you the amount due in interest on your next payment.

This gives you the INTEREST ONLY calculation, what you pay on the capital of the mortgage to pay it down can differ by product.

Remember, manual calculations are only estimates, and your actual monthly payments may differ depending on your lender’s specific policies and terms.

Impact on Monthly Payments

When your mortgage rate increases, your monthly payments will also increase, affecting your monthly budget, the amount of the growth will depend on the size of your mortgage, the length of your mortgage term, and the interest rate increase. It is important to note that the increase in your monthly payments will not only affect your mortgage payments but also your overall financial situation.

We have created a table below to show you how much your monthly payments could increase. This table assumes that you have a mortgage of £250,000, with a 25-year term, and an interest rate of 2.5%. The table shows how much your monthly payments will increase if the interest rate increases by 0.5%, 1%, or 2%.

| Interest Rate | Monthly Payment |

|---|---|

| 2.5% | £1,123 |

| 3% | £1,184 |

| 3.5% | £1,247 |

| 4.5% | £1,375 |

| 5.5% | £1,506 |

As you can see from the table, a slight increase in the interest rate can lead to a significant increase in your monthly payments. It is important to consider these increases’ impact when planning your monthly budget.

Long-Term Financial Planning

When taking out a mortgage, it is essential to consider your long-term financial planning. You need to ensure that you don’t borrow too much money and also not overbid on a property. It would help if you also considered the impact of potential interest rate increases on your ability to repay your mortgage.

One way to ensure you can afford your mortgage payments in the long term is to stress-test your mortgage. This involves calculating how much your monthly payments would be if the interest rate increased by a certain amount. Stress-testing your mortgage ensures you can afford your mortgage payments even if the interest rate increases.

Another way to plan for potential interest rate increases is to consider fixing your mortgage rate. This means that your interest rate will be fixed for a certain period, giving you peace of mind and help you plan your monthly budget.

In conclusion, the effects of a mortgage increase can significantly impact your monthly payments and your long-term financial planning. It is essential to consider the impact of potential interest rate increases and stress-test your mortgage to ensure you can afford your mortgage payments in the long term.

@ebmortgages Little run down on what is happening with mortgage interest rates right now - filmed 18/06/2023 for reference #ebmortgages #mortgageadvice #buyingahouse #mortgageadvisoruk #firsttimebuyer #mortgageuk #mortgagetips #mortgagerates ♬ original sound - Ewa | Your Mortgage Expert

How to Handle Mortgage Increase

If you are facing a mortgage increase, you may wonder what steps you can take to manage the situation. Here are two options to consider:

Refinancing Your Mortgage

Refinancing your mortgage can lower your monthly payments if you can secure a lower interest rate. This means you would take out a new mortgage to pay off your existing one. Before you decide to refinance, it’s essential to consider the costs associated with the process, such as closing costs and application fees.

You should also weigh the benefits of a lower monthly payment against the potential drawbacks of extending the life of your mortgage.

Making Extra Payments

Another way to manage a mortgage increase is to make extra payments towards your principal. This can help you pay off your mortgage faster and reduce the interest you pay over the life of the loan. You can make extra payments by increasing your monthly mortgage or lump sum payment towards your principal. Before making extra payments, check with your lender to ensure there are no prepayment penalties.

In addition to refinancing and making extra payments, there are other steps you can take to manage a mortgage increase. For example, consider cutting back on expenses to save more money for your mortgage payment. You could also look for ways to increase your income, such as taking on a side job or selling items you no longer need.

Remember, managing a mortgage increase requires careful planning and consideration. By exploring your options and taking steps to reduce your expenses and increase your income, you can find a solution that works for you.

Speak to Your Lender

Financial difficulty is a sensitive topic but lenders have a duty of care under FCA regulation to care for their customers and help struggling people where possible. This is especially true after you may be put through vulnerable life events like job loss. Banks have an obligation to help.

Banks can help negotiate new monthly payments you can afford, focus on repayment holidays or other ideas to try and help you weather the storm and higher monthly repayments.

Conclusion

In conclusion, understanding how much your mortgage will go up is crucial for planning your finances. While many factors can influence your mortgage payment, such as interest rates and property taxes, it is vital to keep track of these changes to avoid any surprises.

Using a mortgage calculator, you can estimate how much your monthly payments will increase based on different interest rates and loan terms. This can help you prepare for any future changes in your mortgage payment.

It is also essential to consider the impact of property taxes and insurance on your mortgage payment. These costs can vary depending on the location of your property and the type of insurance coverage you choose.

Keeping track of your mortgage payments and understanding how they may change over time can help you make informed financial decisions.

Stay informed and prepared to ensure your mortgage payments remain manageable and affordable.

10 Minute Read

10 Minute Read